Be aware of impersonation scams

Impersonation scams may involve emails, letters, phone calls or websites that appear legitimate but are designed to trick individuals or businesses into sending money or sharing sensitive information. These scams often use official looking logos, familiar names and urgent language to pressure recipients into acting quickly. Learn how to protect yourself.

We make paying your property tax convenient through My Property Portal

In addition to My Property Portal, we offer other options like: dropping off your payment cheque in one of the drop boxes at City Hall; paying in person during business hours at City Hall; paying by mail, personal online banking, banking by phone or in person; or by enrolling in our pre-authorized debit plan. Our goal is give you lots of options to pay on time and avoid late penalties.

My Property Portal

Welcome to the City of Burnaby's My Property Portal.

- Access your utility fees, property tax, dog and business licence information–anytime, anywhere.

- Sign up for e-billing to receive notices and bills via email.

- View your current and past invoices.

- View your account payment history.

- Check account status to ensure account is up to date and payments are received.

- Access your property’s legal description, assessment history and tax levies.

- Request a new dog licence account.

- Apply for a business licence.

Register a property tax account

If you're a first time user, register for a My Property Profile.

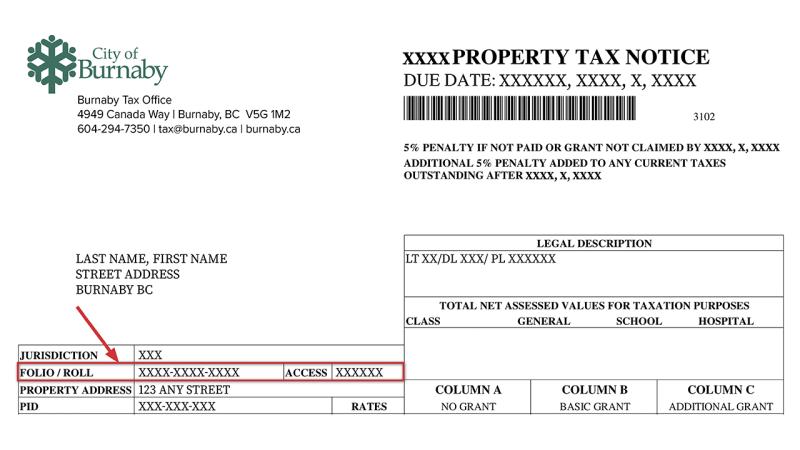

To register your property tax account, you must have your folio number and access code–you'll find them below your name and address on your property tax notice.

Once registered, you can log in to your profile, and then add your property tax account. You can then view your property tax account information by clicking on the account with the dollar sign icon on the Your Account(s) page.

Sign up for eBilling

Receive your tax bill via your email or view it electronically through the secure My Property Portal. When you register for eBilling, you'll no longer receive a paper copy of your tax notice in the mail. You can view your account information online anytime, anywhere. Register today or log in to your account to change your settings.

Protecting your personal information

The personal information collected in My Property Portal is permitted under section 26 of the Freedom of Information and Protection of Privacy Act for the purpose(s) of administering your utilities, property taxes. and dog and business licences for statistical purposes.

If you have any questions about the collection of this personal information please contact Revenue Services. Our address, phone, fax, and email details are located at the bottom of this page.

Alternative ways to pay

These payment methods are also accepted by Revenue Services.

Most financial institutions offer online or phone banking services for a faster and more efficient way to make payments.

For your convenience, here are the most commonly used banks and credit unions where you can submit your online payment(s).

IMPORTANT:

- When paying your property tax online, select the City of Burnaby property tax payee name as it appears in your bank's online banking system. The account number is the 12-digit folio number.

- You'll be subject to a 5% penalty on your property tax amount if

- your financial institution rejects the payment, or

- the payment is made after the financial institution local cut off time on the due date.

- Make your payment earlier to ensure you receive your home owner grant and avoid late payment penalties. If you can, please try to pay your property tax notice at least three days prior to the due date.

- Here’s why: Banks have cut-off times to record their transactions for the day. These cut-off times vary from bank to bank. If you make your property tax payment on the day it's due, but AFTER your bank's cut-off time, the date of your payment will roll over to the next business day and be considered overdue–you won't get to claim your homeowner grant and penalties will be applied.

Having a My Property Portal profile is the easiest way to see your account balance and make payments. If you would like to make a credit card payment without creating a profile, please visit our direct payment page. A non-refundable 1.8% convenience fee will be applied to all credit card payments.

Pay via tellers at most banks and credit unions. The City now has two different payees–City of Burnaby Property Tax AND City of Burnaby Utility Notice. Please make sure the payment is made to the correct payee!

- Keep your receipt for proof of payment. Ensure your financial institution will forward payments by the due date.

- Property tax payments made on or before the due date but received by the City after the July due date will be considered late and penalties will be applied.

- Financial institutions no longer accept home owner grant applications. If eligible, the home owner grant must be claimed by the property tax July due date to avoid penalty.

- Make your payment earlier and if eligible ensure you claim the Home Owner Grant to avoid late penalties. If you can, please try to pay your property tax notice at least three days prior to the due date.

- Here’s why: Banks have cut-off times to record their transactions for the day. These cut-off times vary from bank to bank. If you make your property tax payment on the day it's due, but AFTER your bank's cut-off time, the date of your payment will roll over to the next business day and be considered late.

Mail your cheque and stub well in advance to Revenue Services, 4949 Canada Way, Burnaby BC, V5G 1M2.

- If eligible, don't forget to claim the home owner grant online or by phone before the property tax due date to avoid penalty.

- Please make your cheque payable to: City of Burnaby

- Postdated cheques are accepted to the July property tax due date.

- If you choose this method, mail that's lost or delayed and not received in Revenue Services by the due date will be considered late and a 5% penalty will apply. Postmarks aren't accepted as payment date.

If you wish to pay in person, City Hall is open Monday-Wednesday and Friday, 8 am-4:45 pm, and Thursday, 8 am-8 pm.

24-hour drop boxes are located in the parking lot and at both entrances to Burnaby City Hall, 4949 Canada Way. Drop boxes are cleared daily.

Drop boxes are also located at Bonsor Recreation Complex, Edmonds Community Centre and Eileen Daily Leisure Pool & Fitness Centre. These drop boxes will not be available after 5 pm on the due date.

To qualify for the Pre-Authorized Debit Plan (PAD), you must register BOTH your property tax and utility charges–not one or the other.

The City offers the following option for PAD:

- Variable: 10 equal payments + 1 variable payment for the outstanding balance amount on July 1

Enrolment

To enroll in PAD, download the fillable Pre-Authorized Debit Application Form below. Please complete and return the form in full with your signature and initials where indicated, along with a copy of a void cheque for your bank account.

Please note:

- Your application must be received by the 22nd of the month to take effect the following month.

- Owners who prepay their taxes through PAD earn interest at the prime rate, less 3.5% (with a minimum interest of 0.25% and a maximum of 4.0%).

- PAD monthly payments are applied to annual utility charges and garbage disposal fees. The balance is applied to your property taxes.

- If the account has a balance in arrears or delinquent, those balances plus interest must be paid in full before you can sign up for PAD.

Prepayment interest

The tax and utility instalment payments we collect from you through the pre-authorized debit plan will earn simple interest on your property account’s daily balance. The rate of interest payable to you will be equivalent to the prime rate less 3.5 percent, subject to a minimum interest rate of 0.25 percent and a maximum of 4.0 percent. Note: interest isn’t payable between May 1 and the tax due date.

How to change or cancel your PAD plan

To change or cancel Pre-Authorized Debit, please complete and return the PAD form with your signature and initials where indicated:

- Tick the box that applies to you in section 3 of the form–new, change or cancel.

- If you ticked 'change' for a change of bank accounts, please include a copy of a VOID cheque from the new bank account.

Please note:

- Changes or cancellations must be received by the 22nd of the month to take effect the following month. Please send the PAD form and/or the void cheques to Revenue Services (contact information is at bottom of this page).

- If you sell your property, it's your responsibility as the property owner to instruct the City of Burnaby to discontinue the prepayment plan BEFORE the property is sold. This is important since we may continue to draw payments from your bank account until advised.

- IMPORTANT: Any overpayment will be applied to the new owners. There will be NO refunds on any prepayments, even after the sale of a property. Credits must be adjusted between purchasers and vendors on the Statement of Adjustments.

- If you're eligible, you must claim your home owner grant by the due date to avoid a penalty–even if your taxes are paid by PAD, online/telebanking or your mortgage company.

- Maximum annual prepayments are based on the previous year’s net taxes and utilities.

- Your Pre-Authorized Debit plan will be cancelled by the City and your account will be closed after two payments are dishonoured. Service charges may apply.

- Taxpayers MUST re-apply in writing to start the PAD deductions again.

For information on the Pre-Authorized Debit plan, phone Revenue Services at 604-294-7350.

Contact us

Revenue Services (formerly Tax Office)

Contact Us

- Phone

- 604-294-7350

- Fax

- 604-294-7153

- [email protected]

Hours:

Holiday Hours:

Closed on statutory holidays

About Revenue Services

Revenue Services is responsible for the billing and collection of utilities, garbage disposal fees and property taxes. We also collect taxes for other authorities including Provincial Schools, TransLink, Metro Vancouver, Municipal Finance Authority and BC Assessment. We also provide central revenue receipting services for the City.