2026 Utility Fees are due Monday, March 16, 2026. If you did not receive your utility notice, please contact Revenue Services at 604-294-7350.

Be aware of impersonation scams

Impersonation scams may involve emails, letters, phone calls or websites that appear legitimate but are designed to trick individuals or businesses into sending money or sharing sensitive information. These scams often use official looking logos, familiar names and urgent language to pressure recipients into acting quickly. Learn how to protect yourself.

We make it easy and convenient to pay your utility fees

The City offers many ways to pay your utility fees and charges.

My Property Portal

Welcome to the City of Burnaby's My Property Portal.

- Access your utility fees, property tax, dog and business licence information–anytime, anywhere.

- Sign up for e-billing to receive notices and bills via email.

- View your current and past invoices.

- View your account payment history.

- Check account status to ensure account is up to date and payments are received.

- Access your property’s legal description, assessment history and tax levies.

- View metered water and sewer consumption.

- Request a new dog licence account.

- Apply for a business licence.

Register a utility account in My Property Portal

If you're a first time user, register for a My Property Profile.

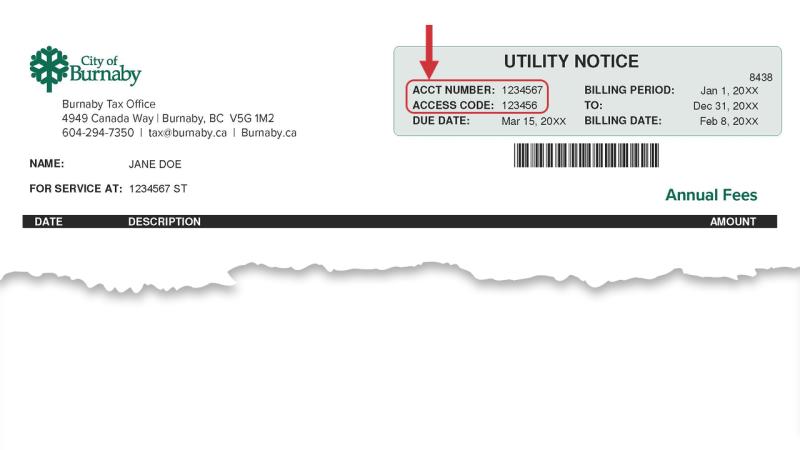

After you create a My Property Portal profile, add your utility account. You will need your utility account number and access code–you can find that in the top right corner of your utility notice.

You can then view your utility account information by clicking on the account with the water faucet icon on the Your Account(s) page.

Sign up for eBilling

Receive your utility bill via your email or view it electronically through the secure My Property Portal. When you register for eBilling, you can view your account information online–anytime, anywhere. Register today or log in to your account to change your settings.

Protecting your personal information

The personal information collected in My Property Portal is permitted under section 26 of the Freedom of Information and Protection of Privacy Act for the purpose(s) of administering your utilities, property taxes, and dog and business licences and for statistical purposes.

If you have any questions about the collection of this personal information please contact Revenue Services. Our contact details are located at the bottom of this webpage.

Alternative ways to pay

These payment methods are also accepted by Revenue Services.

Most financial institutions offer online or phone banking services for a faster and more efficient way to make payments.

For your convenience, here are the most commonly used banks and credit unions where you can submit your online payment(s).

IMPORTANT:

- When paying your utility notice online, select the City of Burnaby utility notice payee name as it appears in your bank's online banking system. Use the 7-digit utility account number from the top right corner of your notice.

- Please check with your financial institution as some banks require up to 3 business days for payment processing.

- Make your payments earlier to ensure you receive the 5% discount. If you can, we recommend making your payment at least three days prior to the due date.

- Here’s why: Banks have cut-off times to record their transactions for the day. These cut-off times vary from bank to bank. If you make your utility payment on the day it's due, but AFTER your bank's cut-off time, the date of your payment will roll over to the next business day and be considered overdue. Then you'll be ineligible for the 5% discount.

Having a My Property Portal profile is the easiest way to see your account balance and make payments. If you would like to make a credit card payment without creating a profile, please visit our direct payment page. A non-refundable 1.8% convenience fee will be applied to all credit card payments.

Pay via tellers at most banks and credit unions. The City now has two different payees–City of Burnaby Utility Notice AND City of Burnaby Property Tax. Please make sure your payment is made to the correct payee!

- Keep your receipt for proof of payment. Ensure your financial institution will forward payments by the due date.

- Please check with your financial institution as some banks require up to 3 business days for payment processing.

- Make your payments earlier to ensure you receive the 5% discount. If you can, we recommend making your payment at least three days prior to the due date.

- Here’s why: Banks have cut-off times to record their transactions for the day. These cut-off times vary from bank to bank. If you make your utility payment on the day it's due, but AFTER your bank's cut-off time, the date of your payment will roll over to the next business day and be considered overdue. Then you'll be ineligible for the 5% discount.

Mail your cheque and invoice stub well in advance to the Revenue Services address you see below.

- Please make your cheque payable to: City of Burnaby

- Postdated cheques are accepted to the March utility fees due date.

- If you choose to mail in your cheque, please be aware that mail that is lost or delayed and not received in Revenue Services by the due date will be considered late and you won't qualify for the paying on-time discount. Postmarks are not considered as date of payment.

If you wish to pay in person, City Hall is open Monday-Friday, 8 am-4:45 pm and open Thursdays until 8 pm for your convenience.

24-hour drop boxes are located in the parking lot and at both entrances to Burnaby City Hall, 4949 Canada Way.

Please note: Drop boxes are cleared daily.

To qualify for the Pre-Authorized Debit Plan (PAD), you must register BOTH your utility charges and property tax–not one or the other.

The City offers the following option for PAD:

- Variable: 10 equal payments + 1 variable payment for the outstanding balance amount on July 1, or

Enrolment

To enroll in PAD, download the fillable Pre-Authorized Debit Application Form below. Please complete and return the form in full with your signature and initials where indicated, along with a copy of a void cheque for your bank account.

Please note:

- Your application must be received by the 22nd of the month to take effect the following month.

- PAD monthly payments collected up to January 1 are applied to the utility fee notice. Any remaining payments collected during the year will be applied to your property tax. If your utility notice has a balance outstanding, it must be paid before the utility due date in order to qualify for the discount.

Prepayment interest

The tax and utility instalment payments we collect from you through the pre-authorized debit plan will earn simple interest on your property account’s daily balance. The rate of interest payable to you will be equivalent to the prime rate less 2.5 percent, subject to a minimum interest rate of 0.5 percent. Note: interest isn’t payable between May 1 and the tax due date.

How to change or cancel your PAD plan

To change or cancel Pre-Authorized Debit, please complete and return the PAD form in full with signature and initials where indicated:

- Tick the box that applies to you in section 3 of the form–new, change or cancel.

- If you ticked 'change' for a change of bank accounts, please include a copy of a VOID cheque from the new bank account.

Please note:

- Changes or cancellations must be received by the 22nd of the month to take effect the following month. Please send the PAD form and/or the void cheques to Revenue Services (contact information is at bottom of this page).

- If you sell your property, it's your responsibility as the property owner to instruct the City of Burnaby to discontinue the prepayment plan BEFORE the property is sold. This is important since we may continue to draw payments from your bank account until advised.

- IMPORTANT: Any overpayment will be applied to the new owners. There will be NO refunds on any prepayments, even after the sale of a property. Credits must be adjusted between purchasers and vendors on the Statement of Adjustments.

- Maximum annual prepayments are based on the previous year’s net taxes and utilities

- Your Pre-Authorized Debit plan will be cancelled by the City and your account will be closed after two payments are dishonoured. Service charges may apply. Homeowners MUST re-apply in writing to start the PAD deductions again.

For information on the Pre-Authorized Debit plan, phone Revenue Services at 604-294-7350.

Contact us

Revenue Services (formerly Tax Office)

Contact Us

- Phone

- 604-294-7350

- Fax

- 604-294-7153

- [email protected]

Hours:

Holiday Hours:

Closed on statutory holidays

About Revenue Services

Revenue Services is responsible for the billing and collection of utilities, garbage disposal fees and property taxes. We also collect taxes for other authorities including Provincial Schools, TransLink, Metro Vancouver, Municipal Finance Authority and BC Assessment. We also provide central revenue receipting services for the City.