Everything you need to know about secondary suites, their benefits and how to build and maintain one

A secondary suite is an accessory dwelling unit fully contained within a primary home.

Secondary suites provide several benefits, including acting as a mortgage helper, increasing the value of your home, facilitating aging in place, offering affordable housing and more.

Apply for a secondary suite

If you want to install a secondary suite or legalize an existing secondary suite in an existing home, you’re required to:

- Meet the zoning conditions: you can only have a secondary suite within a single-family home, duplex, multiplex and/or rowhouse in the following zones: R1, A1, A2, A3 and RM6. Find out if your property qualifies.

- Meet the BC Building Code requirements.

- Obtain the necessary building and subtrade permits.

- Get all the inspections done.

- Fill out a supplementary utility fee declaration and email it to [email protected].

- If the suite is rented out, a supplementary utility fee for water and sewer will be charged on the utility notice.

- Obtain a business license if renting but not living on the property.

If you are building a new home and you will be adding suites, please follow the steps outlined on our New Home Construction webpage.

Do you rent out any part of your property?

If you're a resident who owns a residential dwelling in Burnaby, you are required to complete a Supplementary Utility Fees Declaration to state whether or not you're renting out your home or any suite on your property. If you haven't completed your form, are a new owner, or there's been a change in the rental status of your property, you need to complete a declaration within 30 days of the change.

Send your form by email to [email protected].

If you're renting an unregistered secondary suite, you may have to pay a $1,000 fine under the Burnaby Waterworks Regulation Bylaw and the Burnaby Sewer Charge Bylaw.

The penalty may be issued for any of the following:

- Failing to submit a declaration

- Failing to submit an additional declaration within 30 days following a change in the rental status of a suite

- Submitting a false or inaccurate declaration

As a property owner, you’re also required to submit the supplementary utility fees declaration form if one (or more) of the following conditions apply:

- No previous declaration form was submitted

- There's a change in property ownership

- The rental status of the property has changed

Review our Residential Utility Fees page to learn more.

Questions and answers

In a typical duplex, the residences are placed side-by-side (or front-to-back), whereas in a stacked duplex, they are placed one on top of the other.

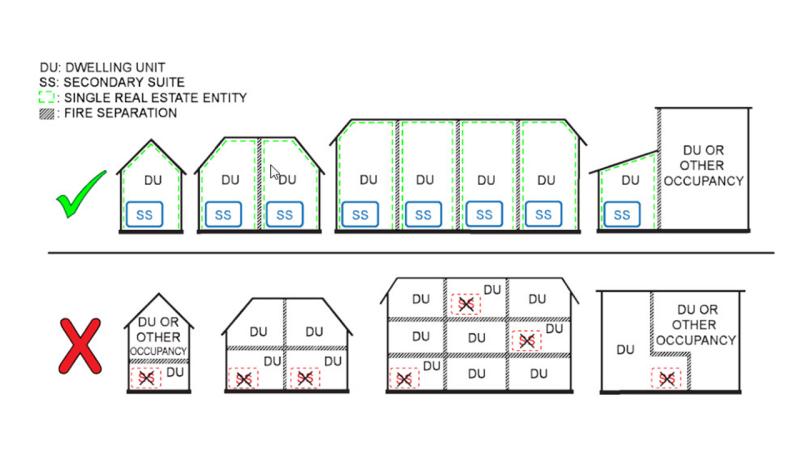

For fire safety purposes, the BC Building Code does not permit secondary suites in duplex homes where one unit is on top of the other. Secondary suites are only allowed in side-by-side or front-to-back duplexes.

The key requirement is that both units are accessed from ground level.

Examples of where secondary suites are now permitted include side-by-side duplexes and rowhouses where a vertical fire separation separates the secondary suite from the remainder of the building.

Examples of where secondary suites are not permitted are up/down duplexes and apartment buildings where dwelling units are above or below other dwelling units.

See the Province's Secondary Suites Bulletin for more information. Also, be sure to contact the Planning Department ([email protected]) to ensure you meet zoning requirements.

Yes, if originally constructed without a building permit, you will need a building permit to ensure that the secondary suite meets building code standards. View information on BC Building Code requirements for secondary suites.

If, for example, the existing permit is for a duplex, you can revise your existing permit to construct a duplex with suites.

If the existing permit is for a single-family home and you want to now build a duplex with suites, the permit will have to be cancelled and you will need to re-apply for a new building permit. The application fee is non-refundable; any additional fees that have been paid will be refunded as per the City’s Fee Bylaw.

Yes, if your lot is eligible for a single-family home, duplex, multiplex and/or rowhouse with suites, you may build a secondary suite in a basement.

Have questions? Contact us:

Supplementary utility fees and declarations

Phone: 604-294-7350

Email: [email protected]