Understanding your bill

Your utility notice will include up to 4 items:

- annual water charge

- annual sewer use charge

- cross connection device charge

- residential garbage toter fee

2026 Utility fees

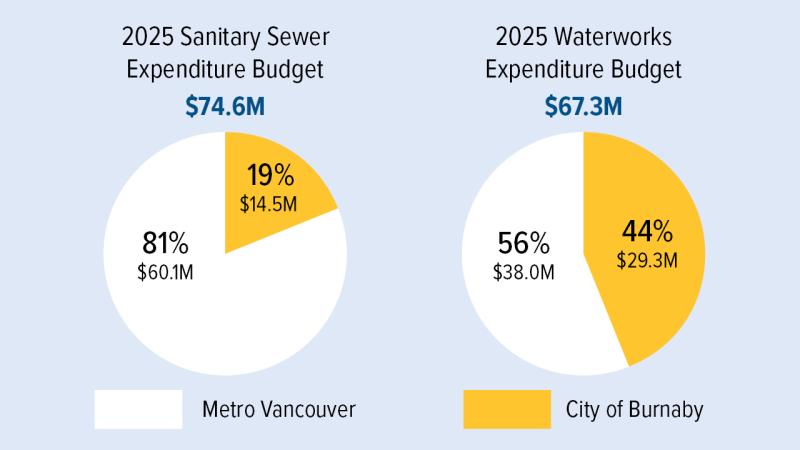

The City of Burnaby uses reserves to lower utility rate increases: Due to major capital works, including the new North Shore Wastewater Treatment Plant Program, Metro Vancouver has significantly increased charges to municipalities, including Burnaby. To limit the impact on residents, the City is using reserve funds to reduce the burden. Learn more.

Water and sewer rates are reviewed annually to ensure that the City can continue to provide quality water and sewer services.

| Residential Type | Water | Sewer Use |

|---|---|---|

| Detached Single Family Dwelling | $652.33 | N/A |

| Rented Suite in a Single Family Dwelling | $326.17 | $403.00 |

| Two Family Dwelling - entire property | $978.50 | $402.00 |

| Two Family Dwelling - stratified | $489.20 | $201.00 |

| Rented Suite in a Two Family Dwelling | $244.60 | $301.00 |

| Multiple Family Dwelling | $374.54 | $436.00 |

- Rates are subject to a 5% discount if paid by the due date.

- Cross Connection Charges will be added when applicable.

- Note: Sewer parcel tax is billed with Property Taxes in May. Sewer Parcel Tax is shared between the number of properties on each parcel of land.

The City collects utility fees on behalf of Metro Vancouver to cover the cost of water and sewer treatment.

The garbage disposal fees for residential pick-up may not change annually.

|

Receptacle Size |

2026 Purchase/Replacement Cost | 2026 Annual Garbage Disposal Fees |

|---|---|---|

|

120 L (small) |

$91.84* | $73* |

|

180 L (default) |

$101.94* | $159* |

|

240 L (medium) |

$112* | $169* |

|

360 L (large) |

$123.20* | $447* |

| One-time exchange fee per address: $52* | One-time exchange fee per address: $52* |

Prices include tax. A 5% discount will apply if your full utility payment is received in Revenue Services before the due date.

Supplementary utility fees for secondary suites

Secondary suites offer a number of benefits–as affordable rental housing, a “mortgage helper” or an option for seniors to 'age in place'. Here's what you need to know about utility fees for your supplementary suite(s).

All owners of single- and two-family homes in Burnaby are required to fill out a declaration indicating whether or not they're renting out their home or a suite on the property. Property owners are only required to submit a Supplementary Utility Fees Declaration form if one (or more) of the following conditions apply:

- a previous declaration form was not submitted

- there is a change in property ownership

- the rental status of the property has changed

If there's a change in the rental status of the property, you must submit a new declaration within 30 days of the change.

Download this fillable form to your device if you're are having difficulties completing it in your web browser. Install Adobe Acrobat Reader or download this app onto your device.

House Rental Licence

If you rent out your home and do not live on the premises, you are also now required to purchase a House Rental Licence instead of paying additional utility fees.

Questions and answers about supplementary utility fees

No - Supplementary Utility Fees are an annual charge. There is no reduction for a change in rental status.

If you are unsure about the status of your property in the future, please submit a declaration based on the current status of the property. If there's a possibility that you'll rent it for any period of time during the year, then a House Rental Licence is required. If your status changes at any time during the year, you must inform the City within 30 days of the change so the City can adjust your records. Please complete the Supplementary Utility Fees Declaration again, indicating a change of status, and submit it to our office via [email protected].

You still need to submit the declaration if the house is under construction. Under section 2 choose the option “property under construction/demolished”. When construction is finished, please complete a new Supplementary Utility Fees Declaration, indicating a change status, and submit it to our office via [email protected] within 30 days of the change status.

Here are links to the bylaws related to this declaration:

- Waterworks Bylaw: Section 41 (1) and (2)

- Sewer Charge Bylaw: Section 4B

- Notice Enforcement Bylaw (see sections for Waterworks, House Rental Business Licence and Sewer Charge Bylaw)

Change of address

It's important to keep your address current for property assessment and taxation purposes.

If the mailing address on your Property Tax bill is incorrect, please complete and submit the Change of Address Area 10, Jurisdiction 301 form directly to BC Assessment.

Please note: It may take a couple of weeks for the City to receive your updated information from BC Assessment.

Contact us

Revenue Services (formerly Tax Office)

Contact Us

- Phone

- 604-294-7350

- Fax

- 604-294-7153

- [email protected]

Hours:

Holiday Hours:

Closed on statutory holidays

About Revenue Services

Revenue Services is responsible for the billing and collection of utilities, garbage disposal fees and property taxes. We also collect taxes for other authorities including Provincial Schools, TransLink, Metro Vancouver, Municipal Finance Authority and BC Assessment. We also provide central revenue receipting services for the City.