Additional information

Property owners receive their assessment notices from BC Assessment (BCA) each January. The overall average residential value increase (used in setting the tax rate) is 1.12% for 2025. While the value of your property may have increased, that does not necessarily mean you will pay more in property taxes. The most important factor in determining how much you will pay in property taxes is how the assessed value has changed compared to similar properties in Burnaby.

An increase in your assessed value exceeding the average will likely mean higher property taxes.

Your assessed value is multiplied by the tax rate for your assessment class and divided by 1,000. The tax rate (or mill rate) is comprised of the rates levied by each taxing authority.

| Taxing Authority | 2025 Residential Mill Rate |

|---|---|

| City | 1.55649 |

| School – Province | 1.01300 |

| TransLink (GVTA) | 0.31410 |

| Metro Vancouver (GVRD) | 0.05800 |

| BC Assessment | 0.03570 |

| Municipal Finance Authority | 0.00020 |

| Total | 2.97749 |

Example

| Assessed Value | X | Mill Rate | / 1000 = | Gross taxes before Local Area Service, sewer parcel and Business Improvement Area charges |

|---|---|---|---|---|

| $1,176,300 | 2.97749 | $3,502.42 |

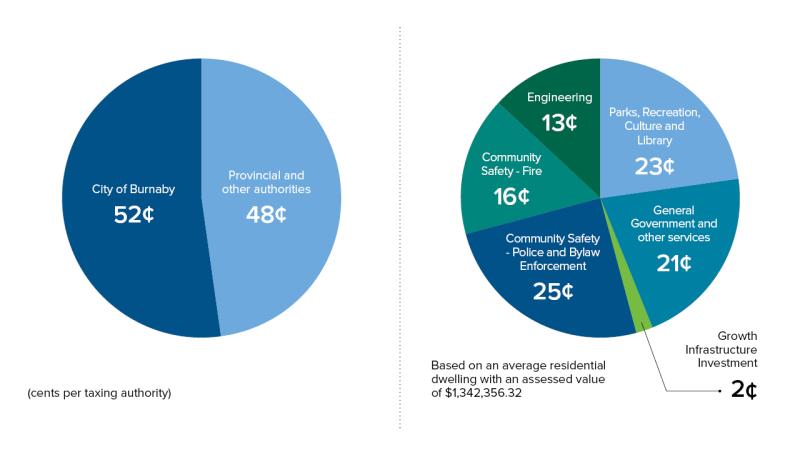

Burnaby keeps 52 cents of each property tax dollar

The City passes on 48 cents of each dollar to the Province and other authorities. Only 52 cents of each dollar collected is used for City services.

How the City’s portion of taxes is spent

The City's portion of property taxes collected is used to provide public services. The majority goes towards funding community safety, parks, recreation, culture and library, and engineering services including maintenance of roads and infrastructure.

The current year's Annual Financial Plan is available in March each year.

Table shows per $1,000 of assessed value:

| Property Class | City Council | School - Prov | Industrial Tax Credit - Prov | School (net of Industrial Tax Credit) | Translink | Metro Vancouver | BC Assessment | Municipal Finance Authority | Total |

|---|---|---|---|---|---|---|---|---|---|

| Residential | 1.55649 | 1.01300 | 0.00000 | 1.01300 | 0.31410 | 0.05800 | 0.03570 | 0.00020 | 2.97749 |

| Utilities | 13.50958 | 11.74000 | 0.00000 | 11.74000 | 2.53560 | 0.20300 | 0.42140 | 0.00070 | 28.41028 |

| Supportive Housing | 1.55649 | 0.10000 | 0.00000 | 0.10000 | 0.00000 | 0.05800 | 0.00000 | 0.00020 | 1.71469 |

| Major Industry | 18.44009 | 1.42000 | 0.00000 | 1.42000 | 1.56130 | 0.19720 | 0.42710 | 0.00070 | 22.04639 |

| Light Industry | 3.93549 | 3.56000 | 0.00000 | 3.56000 | 0.77580 | 0.19720 | 0.10040 | 0.00070 | 8.56959 |

| Business Other | 5.39002 | 3.56000 | 0.00000 | 3.56000 | 0.95180 | 0.14210 | 0.10090 | 0.00050 | 10.14532 |

| Managed Forest Land | 0.00000 | 2.04000 | 0.00000 | 2.04000 | 0.00000 | 0.17400 | 0.24990 | 0.00060 | 2.46450 |

| Recreation Non-Profit | 0.51393 | 2.13000 | 0.00000 | 2.13000 | 0.22590 | 0.05800 | 0.03540 | 0.00020 | 2.96343 |

| Farm | 6.09668 | 7.05000 | -3.52500 | 3.52500 | 0.33810 | 0.05800 | 0.03540 | 0.00020 | 10.05338 |

View Historical Tax Rates section in additional information.

Tables below show the changes to annual tax rates as percentages for each taxing authority.

| Residential (Class 1 ) annual tax rate increases | ||||||

|---|---|---|---|---|---|---|

| Year | City | School | TransLink | Metro Vancouver | BC Assessment | Municipal Finance Authority |

| 2025 | 5.80% | 6.76% | 20.44% | 7.34% | 6.57% | 0% |

| 2024 | 4.50% | 8.95% | 30.83% | 14.94% | 9.46% | 0% |

| 2023 | 3.99% | 9.60% | 9.29% | 15.77% | 8.74% | 0% |

| 2022 | 2.95% | 2.09% | 0.98% | 8.29% | -1.97% | 0% |

| 2021 | 2.95% | 3.14% | 7.71% | 14.40% | 1.23% | 0% |

| 2020 | 1.75% | 1.83% | 5.01% | 13.13% | 1.19% | 0% |

| 2019 | 2.50% | 4.03% | 10.19% | 1.38% | 1.57% | 0% |

| 2018 | 1.50% | 3.22% | 5.59% | 12.47% | 2.03% | 0% |

| 2017 | 2.95% | 5.46% | 3.01% | 8.51% | 5.88% | 0% |

| 2016 | 2.65% | 7.30% | 6.58% | 10.24% | 8.60% | 0% |

| Business (Class 6) annual tax rate increases | ||||||

|---|---|---|---|---|---|---|

| Year | City | School | TransLink | Metro Vancouver | BC Assessment | Municipal Finance Authority |

| 2025 | 5.80% | -1.77% | 5.53% | -3.15% | -2.04% | 0% |

| 2024 | 4.50% | 4.95% | 20.85% | 11.83% | 2.88% | 16.67% |

| 2023 | 3.99% | 6.06% | 3.66% | 15.16% | 4.44% | 25% |

| 2022 | 2.95% | 9.07% | 7.21% | 12.08% | 9.05% | 25% |

| 2021 | 2.95% | 231.81% | -2.98% | 3.84% | -1.64% | 0% |

| 2020 | 1.75% | -68.97% | 5.26% | 26.84% | 5.27% | 0% |

| 2019 | 2.50% | 6.78% | 8.38% | 16.99% | 5.87% | 25% |

| 2018 | 1.50% | 9.35% | 9.23% | 28.62% | 11.60% | 25% |

| 2017 | 2.95% | 4.50% | 2.09% | -3.99% | 4.11% | 25% |

| 2016 | 2.65% | 3.46% | 0.81% | 2.46% | 4.10% | 0% |

Homeowners who qualify for the regular home owner grant of $570 must pay a minimum tax of $350 plus water and sewer use charges.

Home owners qualifying for the regular and additional home owner grants that total $845 must pay a minimum tax of $100 plus water and sewer use charges.

Change of address

It's important to keep your address current for property assessment and taxation purposes.

If the mailing address on your property tax bill is incorrect, please complete and submit the Change of Address Area 10, Jurisdiction 301 form directly to BC Assessment. Please note, this information will only update your property tax and your annual utility notice information.

Please note: It may take a couple of weeks for the City to receive your updated information from BC Assessment.

Related links

Contact us

Revenue Services (formerly Tax Office)

Contact Us

- Phone

- 604-294-7350

- Fax

- 604-294-7153

- [email protected]

Hours:

Holiday Hours:

Closed on statutory holidays

About Revenue Services

Revenue Services is responsible for the billing and collection of utilities, garbage disposal fees and property taxes. We also collect taxes for other authorities including Provincial Schools, TransLink, Metro Vancouver, Municipal Finance Authority and BC Assessment. We also provide central revenue receipting services for the City.